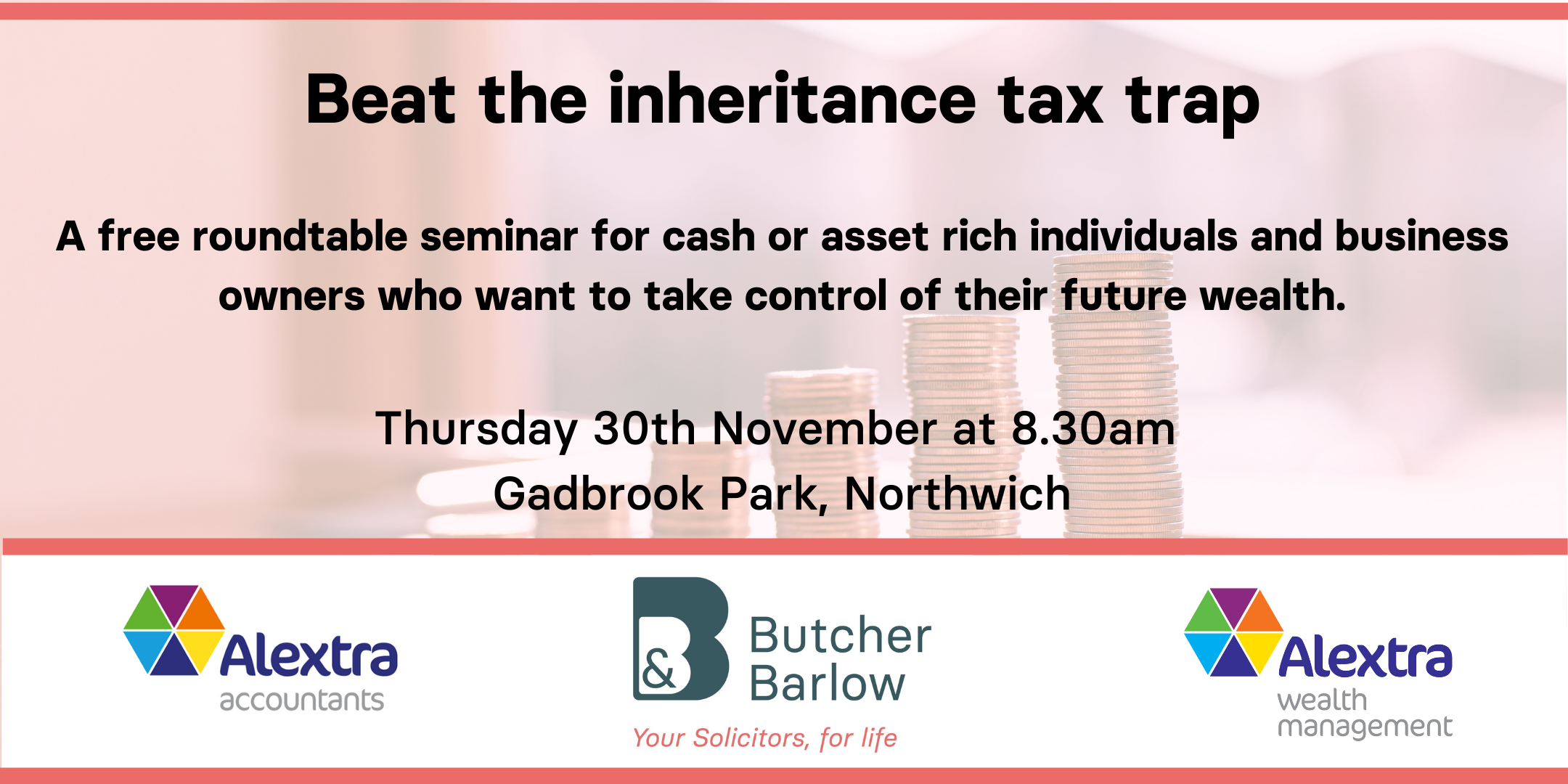

Seminar: Beat the inheritance tax trap

22nd Nov 2023

Author: Butcher & Barlow

You have worked hard to grow your business or to reach a stage where you are earning a six figure salary. You may have inherited assets following a bereavement. Whatever the source of your wealth, you want to protect it for the benefit of your future and that of the next generation. Experts recommend not leaving estate planning until after you retire.

Taking place at 08:30 am on Thursday 30th November at Butcher & Barlow’s offices on Gadbrook Park, Northwich. In this immersive seminar our expert team will provide you with top tips to take you from a standing start to securing your family’s future. With the number of attendees being limited to 10, you’ll have plenty of opportunity to ask questions. Whilst we aim to cover all the topics below, our panelists will be led by you and what you want to know.

Our panel will answer your questions on ways to avoid the inheritance tax trap, which may include:

The Basics: Tim Bailey, Butcher & Barlow Solicitor

- Why you need a Will and a Power of Attorney regardless of your age.

- What is inheritance tax and how does it work.

The Planning: Tim Bailey

- Ways in which you can mitigate inheritance tax.

- Should you put your trust in a Trust?

- How can I transfer my wealth to my children whilst retaining control of the asset?

Tax Mitigation: Shawn Gallimore and Joanne Hamilton, Alextra Accountants

- Mitigating Inheritance Tax – have a plan: A case study or two.

Futureproofing: Steven Pepper, Alextra Wealth Management

- The role of pensions in estate planning.

- Can I protect my investments from the current market and economic uncertainty?

- Check those life policies.